Discover Your Success Path to Financial Independence in 2024

Achieving financial independence is a dream for many among us, offering the freedom to live life without the constraints of traditional work or stress.

But what exactly is financial independence, and how can you create a success path to reach this goal?

In this comprehensive guide, we will break down the key strategies and steps required to achieve financial independence in the U.S.

What is Financial Independence?

Financial independence means having enough assets and passive income streams to cover your living expenses without needing to actively work.

In other words, your money works for you, generating income that frees you from the traditional cycle of employment.

This can be achieved through smart investing, saving, and disciplined financial planning.

Definition and Key Concepts of Financial Independence

Financial independence is not a one-size-fits-all concept.

It depends on factors such as lifestyle, location, and financial goals.

However, the fundamental principle is to create sufficient passive income through investments, savings, and other financial strategies.

Key concepts include:

- Passive Income: Income generated without active work, such as through investments, rental properties, or businesses.

- Net Worth: Your assets minus your liabilities. Achieving financial independence requires a net worth that can support your lifestyle.

- Savings Rate: The percentage of your income that you save and invest toward financial independence.

Why Financial Independence Matters in the U.S.

Financial independence is particularly important in the U.S., where the cost of living continues to rise, and economic stability can be unpredictable.

It allows you to maintain control over your life and finances, rather than being dependent on an employer or government benefits.

The Economic Context and Rising Cost of Living

The U.S. is experiencing growing inflation, high healthcare costs, and a shifting job market.

For many, this means that traditional retirement plans may no longer be sufficient.

Financial independence provides a buffer against economic volatility, ensuring that your financial future is secure.

Setting Clear Financial Goals

The first step on your path to financial independence is setting clear, achievable goals.

These goals should be specific, measurable, and aligned with your long-term vision of financial freedom.

Short-Term vs. Long-Term Financial Goals

Your short-term goals might include building an emergency fund, paying off debt, or saving for a home.

Long-term goals are focused on accumulating enough wealth to cover your living expenses for life.

Balancing these short- and long-term goals is essential for sustainable financial independence.

Building a Strong Financial Foundation

Before you can focus on growing your wealth, it’s important to establish a strong financial foundation.

This includes eliminating high-interest debt, building an emergency fund, and ensuring that your day-to-day financial management is sound.

Eliminate Debt Before Saving

High-interest debt can be a major obstacle to financial independence.

Focus on paying off any debts with interest rates higher than your potential investment returns. This will free up more money to save and invest.

Establishing an Emergency Fund

An emergency fund acts as a financial cushion, protecting you from unexpected expenses such as medical emergencies, car repairs, or job loss.

Aim to save three to six months’ worth of living expenses in an easily accessible account.

Understanding and Controlling Lifestyle Inflation

One of the biggest challenges on the path to financial independence is controlling lifestyle inflation.

As your income increases, it’s easy to start spending more on luxuries, which can delay your progress.

How to Maintain Low Expenses Even as Your Income Grows

To prevent lifestyle inflation, focus on maintaining a frugal lifestyle, even as your income grows.

Redirect any extra income toward savings and investments, rather than splurging on unnecessary items.

Remember, the more you save, the faster you’ll reach financial independence.

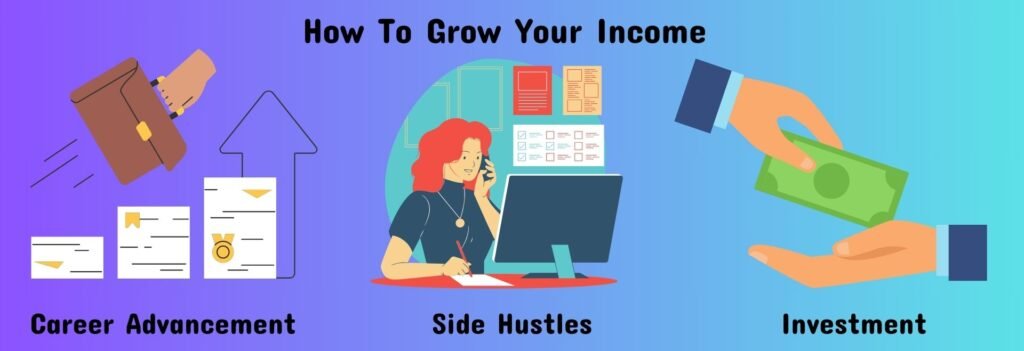

Strategies for Increasing Your Income

To accelerate your path to financial independence, you’ll need to find ways to increase your income.

This can be achieved through career advancement, side hustles, or investing in income-generating assets.

Developing Multiple Income Streams

Relying on a single source of income is risky. By diversifying your income streams, you create a more stable financial future.

Consider investing in stocks, real estate, or starting a small business to generate additional revenue.

Investment Options for Beginners

For those new to investing, start by exploring low-risk options such as index funds, mutual funds, or exchange-traded funds (ETFs).

These options provide diversification and are ideal for long-term wealth building.

Investing for Long-Term Wealth

Investing is the cornerstone of financial independence.

By growing your wealth through investments, you can eventually live off the passive income generated by your portfolio.

Understanding the Stock Market and Investment Strategies

The stock market offers significant opportunities for building wealth.

Whether you choose individual stocks, index funds, or mutual funds, the key to success is consistency and patience.

Regularly investing over a long period will maximize returns while minimizing risk.

Real Estate and Passive Income

Real estate is another popular avenue for achieving financial independence.

Rental properties provide consistent cash flow while offering potential appreciation over time.

Leveraging Real Estate for Financial Independence

Purchasing rental properties can be a lucrative way to generate passive income.

In addition to monthly rental income, you may benefit from property appreciation and tax advantages.

Managing Risk and Protecting Your Wealth

While building wealth is important, it’s equally important to protect your assets.

This means managing risks and ensuring that your wealth is not exposed to unnecessary financial dangers.

Insurance, Diversification, and Minimizing Risk

Insurance is essential for protecting your assets.

Make sure you have adequate health, life, and property insurance. Additionally, diversifying your investment portfolio reduces the risk of significant losses.

Tax-Efficient Investment Strategies

Taxes can take a significant chunk out of your investment returns, so it’s important to understand tax-efficient strategies for investing.

How Tax Planning Can Accelerate Your Path to Financial Independence

Maximize tax-advantaged accounts such as 401(k)s and IRAs.

These accounts allow your investments to grow tax-free or tax-deferred, accelerating your wealth-building efforts.

The Importance of Retirement Accounts

Retirement accounts are a key component of achieving financial independence.

Utilizing tax-advantaged retirement accounts like 401(k)s, IRAs, and Roth IRAs can help accelerate your wealth-building efforts by reducing your tax burden and allowing your money to grow faster.

What is 401(k)s, IRAs, and Roth IRAs: Here’s Explained

401(k): Offered by employers, a 401(k) allows employees to contribute pre-tax income, reducing taxable income in the present while letting investments grow tax-deferred.

Employers often match contributions, adding more value.

IRA (Individual Retirement Account): An IRA is available to anyone with earned income, allowing you to invest in various assets with tax-deferred growth.

Contributions may be tax-deductible depending on your income.

Roth IRA: Unlike traditional IRAs, Roth IRAs are funded with post-tax dollars, meaning your investments grow tax-free, and withdrawals during retirement are also tax-free.

Roth IRAs are particularly beneficial if you expect to be in a higher tax bracket later in life.

Developing Smart Spending Habits

Living below your means is essential for financial independence.

Smart spending habits ensure that more of your income is funneled into savings and investments, rather than wasteful expenses.

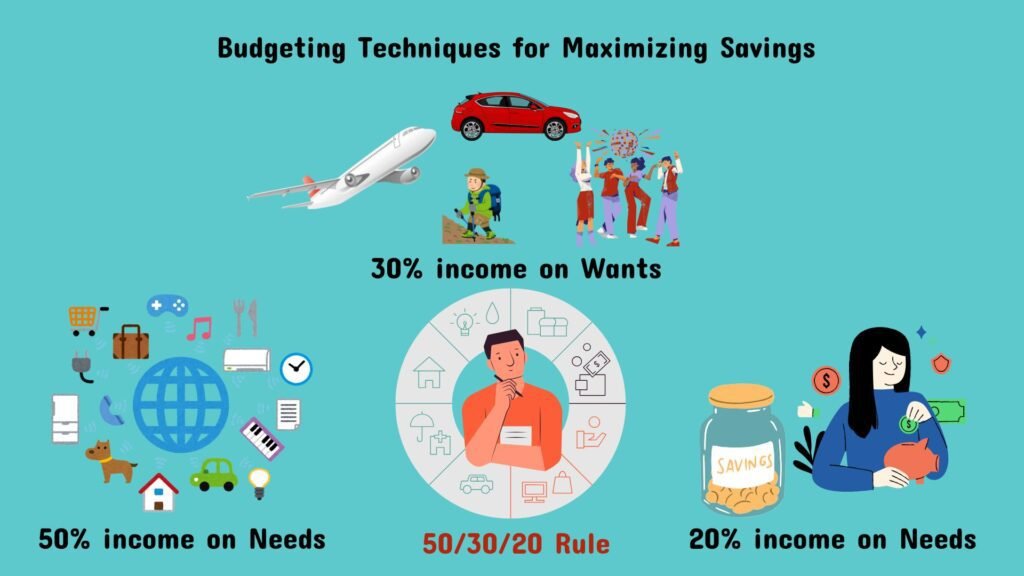

Budgeting Techniques for Maximizing Savings

A well-structured budget is the foundation of financial independence. Here are some effective budgeting techniques to help maximize your savings:

Zero-Based Budgeting: This method requires you to allocate every dollar of your income to specific categories, ensuring that nothing is wasted.

50/30/20 Rule: Spend 50% of your income on needs, 30% on wants, and 20% on savings and debt repayment.

Automate Savings: Set up automatic transfers to savings or investment accounts, so you consistently save without having to think about it.

The Financial Independence and Early Retirement (FIRE) Movement

The FIRE movement has gained popularity as more people aspire to retire early and live off their investments.

The FIRE community emphasizes aggressive savings and smart investing as a way to reach financial independence decades before the traditional retirement age.

Understanding the FIRE Movement in the U.S.

There are several variations of the FIRE movement, including Lean FIRE (retiring with minimal expenses) and Fat FIRE (retiring with a more comfortable lifestyle).

Both approaches focus on high savings rates, often aiming for 50% or more of income, and investing heavily in stocks, real estate, and other assets.

Achieving Financial Independence as a Family

Achieving financial independence doesn’t have to be a solo journey.

Families can work together to build a secure financial future, passing on important financial knowledge to the next generation.

Teaching Financial Literacy to Children

One of the best gifts you can give your children is financial literacy.

Teaching them how to save, budget, and invest from an early age can set them on a path toward financial independence.

Start by introducing basic concepts, such as:

Saving for a goal: Encourage children to save part of their allowance or gift money for something they want.

Budgeting: Teach children the importance of tracking their spending and making decisions based on what they can afford.

Investing: Introduce children to the concept of earning passive income through investing in stocks or mutual funds.

Staying Motivated on the Journey to Financial Independence

Achieving financial independence is a long-term goal, and it can sometimes feel daunting. Staying motivated is crucial for success.

How to Overcome Setbacks and Keep Focus

There will inevitably be setbacks on the path to financial independence—unexpected expenses, market downturns, or personal challenges.

The key to staying motivated is maintaining a long-term perspective.

Keep your eye on the end goal and celebrate small victories along the way. Create a vision board, track your net worth growth, or find a community of like-minded individuals for support.

Achieving Financial Independence Faster: Expert Tips

Many individuals who have successfully achieved financial independence have shared their tips and strategies for speeding up the process.

Key Strategies from Successful Individuals

- Maximize Your Savings Rate: The higher your savings rate, the quicker you can build wealth. Aim to save at least 50% of your income if possible.

- Invest in Low-Cost Index Funds: Index funds offer diversification and low fees, which can lead to higher long-term returns.

- Focus on Tax Efficiency: Take advantage of tax-advantaged accounts like 401(k)s and IRAs to reduce your tax burden and accelerate your path to financial independence.

- Side Hustles and Passive Income: Consider side hustles or investing in rental properties to boost your income and savings rate.

Frequently Asked Questions About Financial Independence

FAQ 1: What is the best age to start working toward financial independence?

The earlier you start, the better. Starting in your 20s or 30s gives you more time to benefit from compound interest. However, it’s never too late to begin building wealth.

FAQ 2: Can I achieve financial independence without investing in real estate?

Yes, many people achieve financial independence solely through stock market investments or other income-generating assets. Real estate can be a powerful tool, but it’s not the only option.

FAQ 3: What are the biggest challenges on the path to financial independence?

Common challenges include lifestyle inflation, market volatility, and the temptation to spend rather than save.

Staying disciplined and maintaining a long-term focus is key to overcoming these hurdles.

FAQ 4: How does financial independence differ from traditional retirement?

Traditional retirement often relies on pensions or Social Security, while financial independence focuses on building a portfolio of assets that generate passive income, allowing you to retire earlier and with more flexibility.

FAQ 5: What are some reliable passive income sources?

Reliable passive income sources include dividends from stocks, rental income, interest from savings accounts or bonds, and income from businesses or side hustles.

FAQ 6: How much money do I need to achieve financial independence?

The amount of money needed varies based on your lifestyle and expenses. A common rule of thumb is the 25x rule, where you aim to save 25 times your annual living expenses.